Out of sight out of mind. Layoffs are happening all around us but it will never be me. I work hard, my group is successful, and my manager loves me.

Yet, I bet you know someone who has been laid off. If you don’t, you just haven’t met them yet. Layoffs are happening all around us and to us. You can quickly google layoffs in the news and find large lists of planned layoffs in all industries:

- Headlining grabbing numbers like tech having 396% more job cuts in 2023 than 2022.

- Citi cutting 20,000 employees

- Rent the runway cutting 10% of it’s workforce

- Bumble lays off over 30% of it’s workforce

This is not fear mongering or clickbait – this is reality; this is really what’s happening in 2024. What is the correct response to all this negative news? Some people will immediately start their job search while others will just simply think, “not going to happen to me.” The best answer lays somewhere in between those two responses. Let’s fire it up!

Measuring Layoffs

Layoffs of 10%, 30%, 20,000 – all these numbers sound like a lot, and they are. In fact, in the post-pandemic years (2021-2023) there were over 54 million layoffs! But the total layoff and discharge rate during this time was only 1%. The total layoff rate from 2021-2023 has been right at 1%. How does that make any sense? Stick with me here:

Layoffs & Discharges are defined as (note in this post, the term ‘layoffs’ is used in place of ‘layoffs & discharges’):

- Reductions in Force, including from M&A activity

- Firing for cause and/or performance

- Ending of seasonal employees

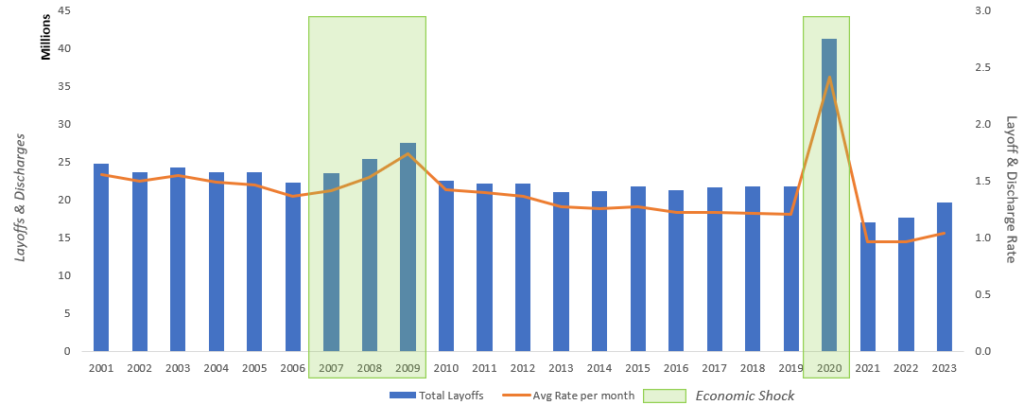

The average total employment per month in the US was 161 million for 2023. The average total layoffs and discharges per month was 1.6 million. That gets us to the 1% layoff and discharge rate. But don’t get it twisted, that is still over 19 million layoffs in 2023! As the graph below shows us, we are currently historically low in both total layoffs and layoff rates. The main driver of layoffs are major economic shocks, like the Financial Crisis and Covid. The rates are low but the total numbers are still high!

“During the post-pandemic years (2021-2023) there were over 54 million layoffs! But the total layoff and discharge rate during this time was only 1%.”

Industry as a Layoff Driver

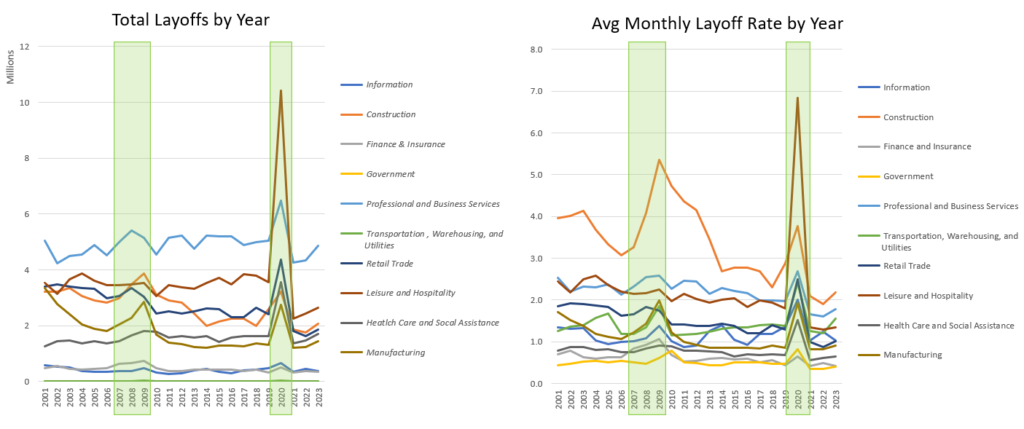

The industry you are in is one of the biggest factors in your risk for being laid off. While economic shocks rattled all industries, it does so in varying degrees.

Comparing 10 industries/sectors (using sectors from the North American Industry Classification System):

- Construction and Leisure & Hospitality have the highest average layoff rate and the highest variability — meaning they are most likely to be laid off and more impacted when economic shocks do occur.

- To nobody’s surprise, Government roles have easily the lowest layoff rate and lowest variability. Meaning all those DMV workers & politicians aren’t going anywhere anytime soon, even if the whole word shuts down (see Covid) or the banking system collapses (see 2007-2008).

- What did surprise me is that Information (which encompasses what we think of as “tech” type companies) is actually on the low end of the layoff spectrum. This is likely surprising as tech layoffs are high profile but you have to really dig to find how construction is doing.

- This likely due to more coverage on the most valuable public companies, which tech companies largely drive.

For industry/sector definitions, visit: https://www.census.gov/naics/

“Construction and Leisure & Hospitality … are most likely to be laid off and more impacted when economic shocks do occur.”

3 QUESTIONS TO ASSESS YOUR LAYOFF RISK

Layoffs do occur, regularly, en masse. But that also does not mean a layoff is imminent. So, use this time to grow your skills, gain valuable experiences, and make yourself more marketable. And if you are worried about your status, use the questions below to help guide how at risk you are:

- Do I work in a business that has business cycles within my industry?

- Does my work staff up or down during certain parts of the year?

- Does revenue in my business depend on product releases or improvements?

- What does M&A look like in my industry?

- What external forces can/are impacting my business?

- How likely is my business to be disrupted by innovation?

- Is the government likely to regulate or deregulate in my area?

- Is my business reliant upon another sector that may have cycles or risks?

- Is that other industry likely to experience labor strikes or price increases?

- e.g. Leisure and hospitality need people to travel. It will hurt if Airlines rise prices or pilots go on strike.

- Is the industry at risk of losing funding or decreasing investment?

- e.g. Construction is reliant upon banks to finance new projects. If interest rates spike or funding decreases, there won’t be projects.

- Is that other industry likely to experience labor strikes or price increases?